- Lucid Group aims to compete with automotive giants by doubling its revenue by 2025, driven by the launch of the Gravity SUV.

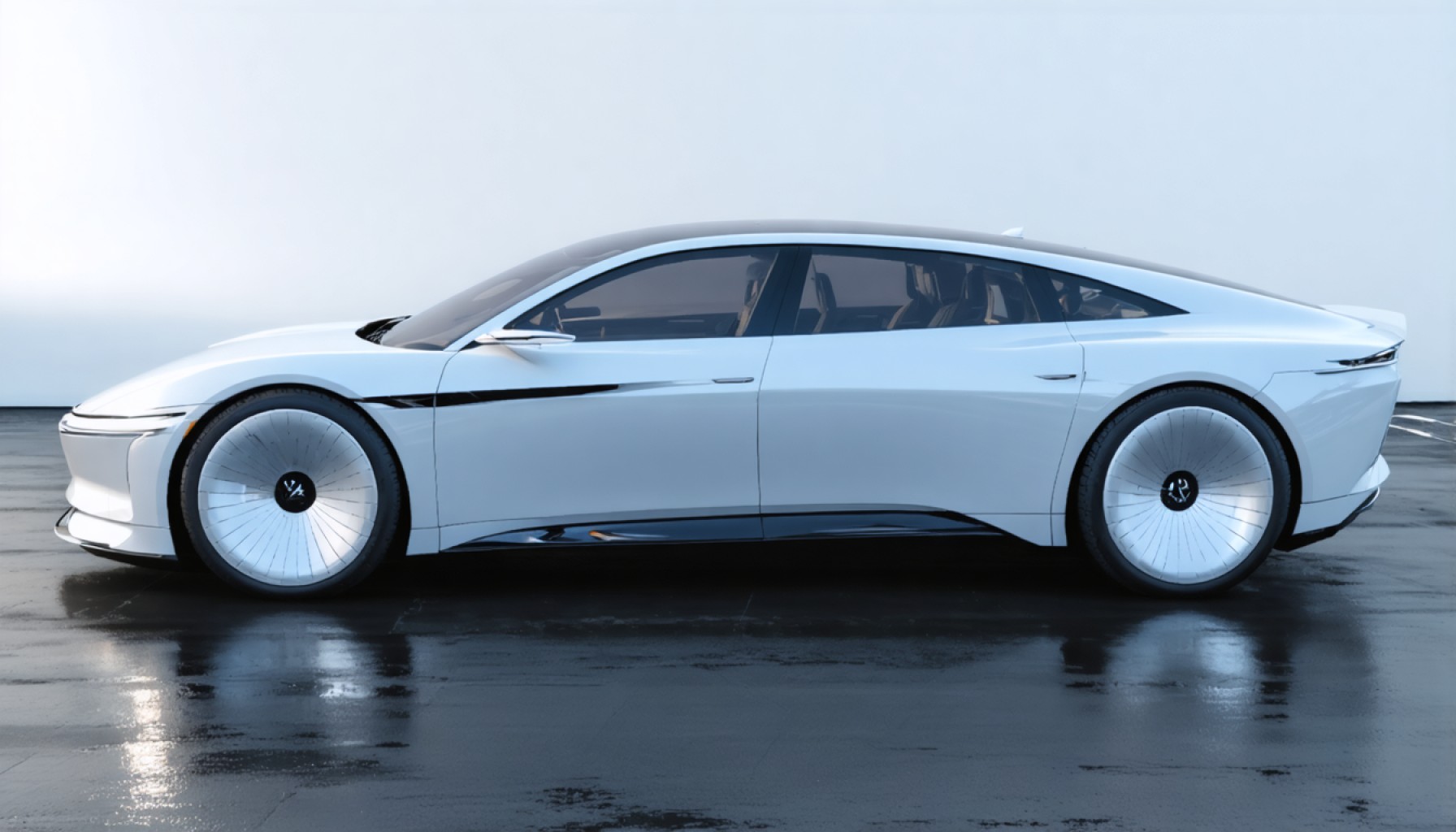

- The Gravity SUV promises to blend luxury with sustainable technology, reshaping the electric vehicle narrative.

- Lucid’s stock has dropped by about 20% this year, reflecting broader market issues affecting electric vehicle stocks.

- Past sales growth optimism, including a significant deal with the Saudi government, has not translated into sustained market confidence.

- Investors are cautious due to Lucid’s smaller market stature and inconsistent sales performance.

- The market remains wary of Lucid’s ability to turn ambitious forecasts into consistent growth.

- Lucid’s potential is acknowledged, but investors are advised to exercise patience and discernment.

Amidst the roar of innovation on the electric frontier, Lucid Group shines with its grand ambition to rival automotive giants—and yet, its shares languish in the depths of market skepticism. As 2025 unfolds, analysts have set their sights on Lucid’s new aspirations, foreseeing a near doubling in revenue by 2025 powered by the impressive roll-out of the Gravity SUV. This vehicular marvel has promised to break new ground, blending luxury with sustainable technology, capturing imaginations and promising to redefine the electric car narrative.

However, as stock prices tell a different tale, Lucid’s trajectory seems less like a meteoric rise and more like an enigmatic waltz through the volatility of market moods. Since the onset of the year, Lucid’s shares have dipped by about 20%, a drop tied to broader market corrections that saw many electric vehicle stocks grappling with similar woes.

Lucid’s story is not without its past echoes. Back in 2024, whispers of skyrocketing sales growth filled the air, ignited by lucrative deals like the substantial sale to the Saudi government. Optimism rushed in, yet Lucid’s market valuation barely flinched. As the months went by, reality pricked those inflated expectations with unanticipated sluggish sales, proving the market’s doubts prescient.

Investors eyeing Lucid’s seemingly attractively priced stock might be lured by dreams of unrecognized potential. Yet caution intertwines with this temptation. The realities of market behavior indicate that Lucid’s valuation is affected by factors beyond mere growth projections. Its stature as a smaller player compared to behemoths like Tesla raises questions about its long-term viability in a fiercely competitive landscape. Moreover, past inconsistencies in sales performance contribute to a cautious approach by the market.

Thus, Lucid’s stocks remain in a curious limbo; they trade at a discount that mirrors investor wariness. The key takeaway is clear: Lucid Motors, with all its innovative brilliance, walks a road shadowed by the need to convert forecasts into tangible, sustained growth. Only when it forges this path convincingly will the market likely embrace Lucid’s full potential.

In essence, Lucid may indeed be a diamond in the rough, but for investors poised to leap, patience and discernment are paramount.

The Next Big Thing in Electric Vehicles: Will Lucid’s Gravity SUV Change the Game?

Lucid Motors: Breaking Down Barriers in the Electric Vehicle Market

Introduction to Lucid Motors’ Ambitions and Challenges:

Lucid Motors, with its sleek lineup of electric vehicles (EVs), aims to challenge conventional automotive giants such as Tesla. Analysts predict a doubling of revenue by 2025, largely due to the introduction of the Gravity SUV. Despite these promising forecasts, Lucid’s stock performance remains subdued, presenting a complex puzzle for investors.

Understanding Lucid’s Market Dynamics

1. Market Trends and Forecasts:

– Electric Vehicle Industry Growth: The global EV market is projected to grow significantly, driven by increasing environmental concerns and supportive government policies. According to a report by IEA, the number of electric cars on the road is expected to reach 145 million by 2030. Lucid stands to benefit from this surge but must secure a strong foothold amidst fierce competition.

– Lucid’s Revenue Projections: With the upcoming launch of the Gravity SUV, Lucid aims to nearly double its revenue. Success will depend on market reception and the company’s ability to scale operations effectively.

2. Reviews and Comparisons:

– Lucid Gravity vs. Tesla Model X: The Gravity SUV is anticipated to compete directly with Tesla’s Model X. While both offer luxury and advanced technology, Lucid’s focus on combining sustainability with luxury will be crucial to capturing consumer interest.

– Performance Metrics: Industry insiders highlight Lucid’s emphasis on range and performance. The Lucid Air, for example, boasts a range of over 500 miles on a single charge, setting high expectations for the Gravity SUV.

3. Challenges and Limitations:

– Market Volatility: Lucid’s stock price reflects broader market trends affecting the EV sector. Market corrections and fluctuating demand pose challenges.

– Production and Delivery Delays: Previous unanticipated sluggish sales highlight Lucid’s production challenges. Ensuring timely delivery of the Gravity SUV is crucial to maintaining investor confidence.

Real-World Use Cases and How-To Guide

1. Life Hacks for Prospective Lucid Owners:

– Maximizing Vehicle Range: Regular maintenance and optimal charging practices can extend the vehicle’s range. For instance, it is advisable to use Level 2 home chargers for efficient energy consumption.

– Utilizing Software Features: Lucid vehicles come equipped with advanced software for navigation and range prediction. Familiarize yourself with these features to enhance your driving experience.

2. Investment Insights:

– Cautious Approach Recommendations: For current or prospective investors, exercising patience and thorough research is vital. Monitoring Lucid’s quarterly earnings and production milestones can provide valuable insights into future stock performance.

Environmental and Sustainability Considerations

1. Sustainable Manufacturing Practices:

Lucid is committed to sustainability, utilizing eco-friendly materials and green manufacturing processes. This aligns with the increasing consumer demand for environmentally responsible companies in the automotive industry.

Conclusion and Actionable Tips

– For Investors: Research thoroughly and consider diversification to mitigate risks associated with market volatility.

– For Potential Buyers: Keep an eye on the Gravity SUV’s launch details and compare its features with those of competitors before making a purchase decision.

– For Environmental Advocates: Support brands like Lucid that integrate sustainability into their business models; this can accelerate the adoption of green technologies.

Lucid Motors continues to captivate the market with its potential. As the company addresses production challenges and expands its lineup, it holds promise for becoming a prominent player in the EV landscape.

For more insights into the automotive industry and electric vehicle trends, visit the official Lucid Motors website.